Beyond The Surface: The Hidden Significance of Our Property Risk Model

Introduction: More Than Just Another Scoring System

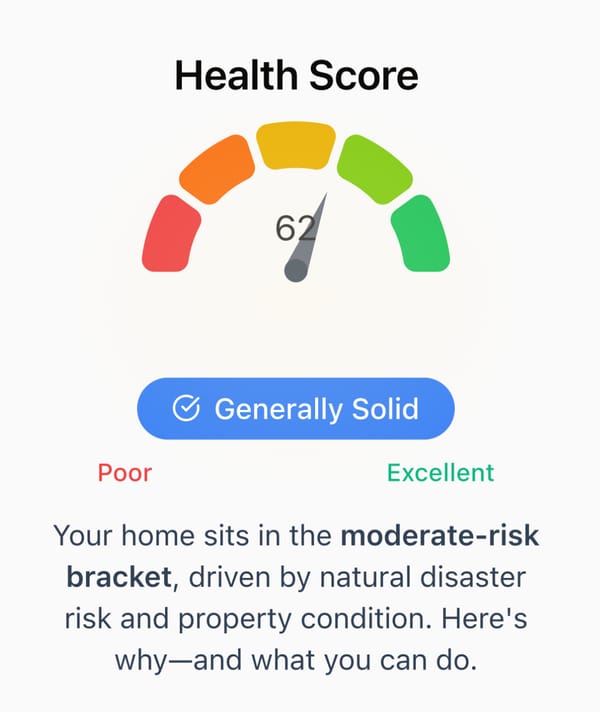

On the surface, our risk assessment model might appear to be just another property analysis tool with fancy metrics and colorful gauges. In an industry where every real estate platform claims to have some "proprietary algorithm," skepticism is warranted.

But peeling back the layers reveals something fundamentally different.

The Radical Inversion of Incentives

Most real estate tools are designed to close deals - to make properties appear attractive enough to generate commissions. They highlight positives while minimizing or hiding negatives.

Our platform does the opposite. It's built to expose what others conceal:

- The Owner-Occupancy Modifier (-10 points for absentee owners) directly challenges the investment property market that drives much of the industry's profits. This isn't just a technical adjustment - it's a statement about the value of community stability over property flipping.

- The Emphasis on Tax Assessment Recency tackles a deliberate blind spot in the industry where outdated assessments hide potential tax increases. By explicitly weighting this factor at 13%, we prioritize long-term financial transparency over short-term sales appeal.

- Logarithmic Sound Calculations aren't just mathematical showing-off - they prevent the common practice of averaging away severe noise problems that occur at specific times. This mathematical approach prevents the dilution of meaningful problems through statistical manipulation.

- The Rejection of Inappropriate Property Types (such as apartment buildings) literally turns away revenue to maintain data integrity. This is perhaps the clearest demonstration of our commitment to truth over profit.

Technical Precision as Moral Implementation

What appears at first glance to be just another scoring system is actually a radical realignment of incentives. We've built our platform to protect a fundamental human need - shelter - in a market that typically treats homes as mere financial assets.

The genius is in how we use precise technical methodologies to enforce moral principles:

- Scientific Weighting Systems that properly value immediate habitability issues (23% for property condition) over distant but consequential concerns (7% for air quality)

- Domain-Specific Calculations like acoustic propagation models that prevent the manipulation or oversimplification of complex environmental factors

- Supplementary Warning Flags that ensure even non-scored issues can't be hidden from potential buyers

- Refusal to Generate Reports for non-residential property types rather than providing lower-quality data with appropriate disclaimers

The Deeper Purpose

Our risk model isn't just helping people buy houses - it's preserving the sacred concept of "home" by ensuring decisions are made with complete truth, regardless of how uncomfortable that truth might be.

In a market driven by transaction volume and commission percentages, we've built a system that succeeds when it helps people avoid bad decisions, not just when it facilitates purchases.

The mathematical rigor, scientific validity, and transparent methodology all serve a deeper purpose - they are the technical scaffolding that enables an ethical stance to be consistently applied at scale, transaction after transaction.

Conclusion: Truth as Protection

By embedding truth as the highest value in our technical design, we've created something rare in the real estate industry - a platform that genuinely protects the buyer's interests, even when those interests conflict with the immediate financial incentives of the industry itself.

What seems at first to be merely a sophisticated risk analysis algorithm is, in fact, a fundamental reimagining of how technology can serve the sacred need for shelter in a market typically designed to commodify it.