Flood-Zone Mirage: How “X-Zone” Homes Still Rack Up $20k+ Losses

Snapshot

• 40 % of all NFIP flood-damage claims come from outside the high-risk (A / V) zones—mostly from the so-called “low-risk” X-zones. (Are You in a Flood Zone? What FEMA's 2024 Flood Map Mean for You)

• NFIP’s average paid claim topped $66,000 between 2016-2022; the median homeowner disaster grant was just $3,000. (Everyone Needs Flood Insurance | FEMA.gov)

• Federal flood maps update slowly; urban infill and climate-driven rainfall extremes are outrunning them by 5–10 years in many counties.

1. Why “Not in a Flood Zone” Is a Linguistic Trap

FEMA maps label moderate-to-low-risk areas as Zones B, C, or X. Lenders don’t require flood insurance there, so listings flaunt the phrase “No flood zone insurance required.”

Reality check:

| Claim Source | Share of NFIP Payouts |

|---|---|

| High-risk A/V zones | ~60 % |

| So-called low-risk B/C/X zones | ≥ 40 % (Are You in a Flood Zone? What FEMA's 2024 Flood Map Mean for You) |

Translation: four out of every ten checks FEMA cuts go to people who thought they were “safe.”

Want to see the data on your own address?

Run a FREE sample Property Insights report in 30 sec—no credit card, no spam.

2. Three Reasons the Maps Miss

- Static cartography vs. dynamic hydrology

Maps freeze a snapshot; beaver dams, new subdivisions, or wildfire-scorched slopes can reroute runoff within a single season. - 200-year benchmark delusion

Zone X (shaded) covers the 0.2 %-annual-chance flood. Climate records show formerly “500-year” events striking every 50–75 years in parts of the Midwest and Southeast. - Urban sheet flow

Impervious surfaces multiply; storm drains clog. The result isn’t riverine overflow but street-level flash flooding—unmapped but equally destructive.

3. Cost Delta: Insurance vs. Out-of-Pocket Reality

| Scenario | Before Flood | After Flood | Net Hit |

|---|---|---|---|

| Home w/ NFIP policy | $600 / yr premium (Zone X) | Average claim $66 k paid | –$600 (premium) |

| Home without policy | $0 | FEMA grant ~$3 k + SBA loan (interest) | –$63 k + debt ([Everyone Needs Flood Insurance |

Even a “cheap” $20 k remediation—drywall, flooring, appliance swap—lands squarely on uninsured owners.

4. Risk Rating 2.0: The Premium Shake-Up

FEMA’s new actuarial engine prices risk property-by-property, not zone-by-zone. Early data:

- Average premium change: ± $8–$20 mo for 96 % of policies, but high-value coastal X-zone homes can jump triple-digits. ([PDF] Risk Rating 2.0 | FEMA)

- Preferred-Risk Policies (cheap X-zone flat rate) have been phased out entirely. (| Flood Insurance Data and Analytics)

Expect lender scrutiny to follow—some banks already flag high-WLM (water-loss model) scores independent of FEMA maps.

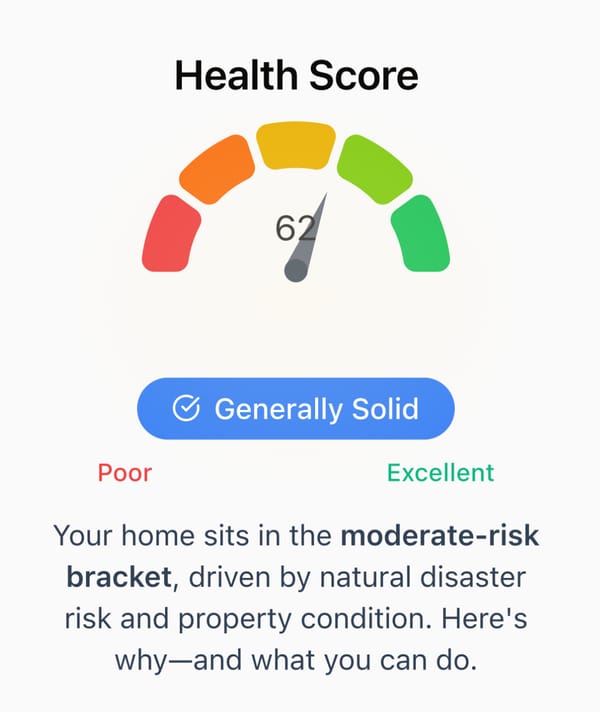

5. How Property Insights 101 Quantifies “Invisible” Flood Threat

| Data Layer | What We Pull | Model Weight |

|---|---|---|

| FEMA FIRMs + Letter-of-Map Changes | Baseline zone + recent appeals | 20 % |

| NOAA Atlas 14 & local rain-gauge trends | Shifting intensity-duration-frequency curves | 25 % |

| Elevation & LiDAR surface flows | Street-level ponding depth at 100-yr storm | 25 % |

| NFIP claims density (de-identified) | Historical loss clusters | 15 % |

| Parcel-level mitigation (french drains, berms) | Credits for engineered protection | 15 % |

Output: Flood Exposure Score (FES) 0-100. Anything ≥ 70 triggers:

- Loss-scenario table (1 % vs 0.2 % annual chance events)

- Premium forecast under Risk Rating 2.0

- Mitigation ROI—e.g., $4 k perimeter drain yields expected $11 k avoided loss over 10 yrs.

6. Action Checklist

| Stakeholder | Must-Do |

|---|---|

| Buyers | Order an FES before waiving inspection; budget insurance into DTI ratios. |

| Inspectors | Photograph grading, downspouts, crawl-space moisture; flag if FES ≥ 70. |

| Agents | Disclose past water intrusion receipts—even in X-zones—to avoid post-close litigation. |

7. Takeaway

Flood water respects no ink on a federal map. Zone X is not a force-field; it’s a statistical comfort blanket that climate volatility is already ripping apart.

Property Insights 101 turns outdated contours into parcel-level probabilities—so you can plan, price, and protect before the basement turns into a riverbed.

That wraps our “Big Three” climate hazards series. Up next: decoding air-quality history—and why a single summer of wildfire smoke can slash HVAC life by 50%.

Want to see the data on your own address?

Run a FREE sample Property Insights report in 30 sec—no credit card, no spam.