Ghost Permits & Hidden Additions: Why Renovation History Can Make—or Break—Your Closing Table

Quick Stats

• Up to 45 % of major U.S. remodels never pull the required permits (NAHB survey).

• Mortgage underwriters flag unpermitted square-footage as a “collateral defect,” stalling—or canceling—funding in 24 % of disputed appraisals (Fannie Mae QC data).

• Average cost to retro-permit a non-conforming addition: $8,500 – $27,000 (permit fees, code upgrades, engineering sign-off).

1. Why Permits Matter More Than Paint Color

A glossy kitchen photo can sell a listing, but the paper trail behind that kitchen determines:

| Factor | Hidden Risk | Potential Hit |

|---|---|---|

| Financing | Appraiser must ignore unpermitted sqft → LTV ratio spikes | Loan denial or higher rate |

| Insurance | Carriers exclude fire/flood claims tied to non-code wiring or plumbing | Full loss out-of-pocket |

| Liability | Future buyers can sue for undisclosed work | Six-figure legal & repair bills |

Bottom line: If the remodel isn’t in county records, you’re buying uncertainty.

2. Spotting the “Ghost Permit” Patterns

- Square-Footage Delta

MLS lists 2,400 sq ft; assessor shows 1,950 sq ft → 450 sq ft likely unpermitted. - Valuation Spike Without Permit Log

Assessed value jumps $110 k YOY but no corresponding building permit number → interior gut remodel minus paperwork. - Closed Permits With No Final Inspection

Permit status = “Expired – Work Not Finaled.”

Translation: inspector never signed off; code compliance unknown.

Want to see the data on your own address?

Run a FREE sample Property Insights report in 30 sec—no credit card, no spam.

3. How Property Insights 101 Surfaces the Red Flags

| Data Source | What We Pull | How We Score |

|---|---|---|

| County & city permit APIs | Issuance dates, valuations, contractor IDs, final-inspection status | Open vs. closed score |

| GIS & assessor roll | Living-area history, valuation trendlines | Sq-ft delta flag |

| Satellite & street-view imagery | Roofline / footprint change detection (computer vision) | Confidence overlay |

| MLS revision logs | Listing sqft edits over time | Consistency penalty |

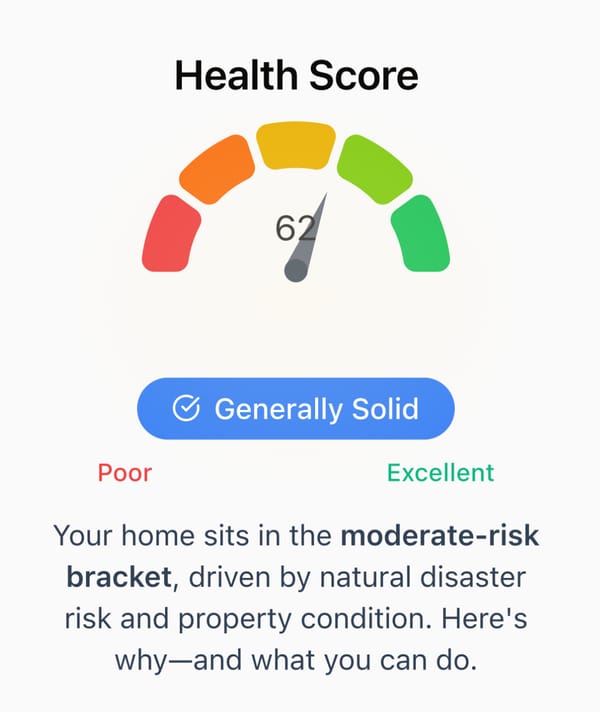

These feeds roll into our Permit Integrity Index (PII)—a 0-100 score that weights recency, inspection completion, and delta magnitude. A PII below 65 triggers an “Unverified Addition” banner in the report, along with cost-to-cure estimates and local contractor averages.

4. Real-World Example

Case ID: PI-WA-23-1178

1978 rambler, Tacoma WA | Listed 2,220 sq ft | Assessor 1,680 sq ft

• Permit search: No records post-1995.

• Imagery analysis: 14 × 30 ft rear bump-out visible after 2016.

• PII score: 42 (High Risk).

• Outcome: Buyer negotiated $26 k credit; seller retro-permitted before close.

Without the data, that credit would have been the buyer’s future problem—along with a non-insurable electrical panel.

5. Action Steps for Buyers, Inspectors, and Agents

| Role | Do This Now | Why |

|---|---|---|

| Buyer | Ask for a permit ledger alongside the seller’s disclosure. | Disclosure forms often skip expired/open permits. |

| Inspector | Include county permit status in every report, not just a footnote. | Elevates diligence → referral differentiator. |

| Agent | Run a P.I. 101 report before listing photos. | Surprises found early save escrows later. |

6. Takeaway

A fresh coat of paint hides drywall seams; a missing permit hides legal, financial, and safety landmines.

Property Insights 101 turns scattered permit crumbs into a single risk score, so you can negotiate—or walk—before signing.

Want to see the data on your own address?

Run a FREE sample Property Insights report in 30 sec—no credit card, no spam.