The True Cost of Buying a Home: Why Affordability Is More Than Your Mortgage

Quick Facts

• In 2024, 35% of U.S. homebuyers underestimated non-mortgage living costs.

• Areas with “low property taxes” often offset that with higher

transportation or food costs.

• The average buyer spends $12,000/year on location-driven living expenses beyond housing.

Want to see the data on your own address?

Run a FREE sample Property Insights report in 30 sec—no credit card, no spam.

1. Why Affordability Is More Than a Monthly Payment

When buyers calculate “what they can afford,” they typically think about:

- Mortgage principal & interest

- Property taxes

- Insurance

But these costs are only half the story.

Day-to-day living expenses—like commuting, groceries, child care, and energy costs—can vary dramatically from one location to another.

Two homes with identical mortgage payments can differ by $1,000+/month in living costs.

2. What Drives the Hidden Costs

| Category | Why it varies |

|---|---|

| Transportation | Long commutes, gas prices, lack of public transit |

| Utilities | Older home systems, local energy rates, climate zone |

| Groceries | Regional supply chains, inflation volatility |

| Healthcare | County health costs, insurance availability |

| Child care & education | Private vs public school reliance, licensing costs |

Even neighborhoods with low home prices may have high lifestyle costs.

3. Takeaway

A home’s price is only the beginning.

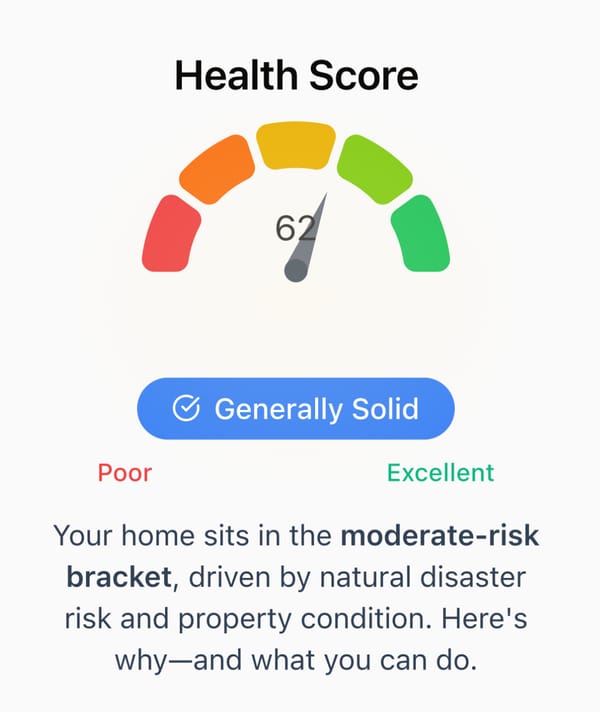

PropertyInsights101 helps buyers see the total cost of living before committing—not after closing day.

Want to see the data on your own address?

Run a FREE sample Property Insights report in 30 sec—no credit card, no spam.