Wildfire Risk Isn’t Just a “Forest Problem” —It’s a 2.6-Million-Home, $1 Trillion Reality

TL;DR

• 2.6 million U.S. homes now sit in moderate-to-very-high wildfire-risk zones, with a $1.3 trillion reconstruction price tag. (CoreLogic 2024 Wildfire Risk Report Finds More Than 2.6 Million ...)

• Even outside the flames, indoor PM₂.₅ spikes during smoke events can exceed EPA safe levels by 5–10× and infiltrate homes for days. (Why Wildfire Smoke is a Health Concern | US EPA)

• Insurance markets are tightening; some carriers have exited entire states due to soaring wildfire claims. (How wildfires became a burning issue for insurance professionals)

1. The Expanding Heat-Map of Risk

CoreLogic’s 2024 Wildfire Risk Report pegs 2.6 million properties across 14 western states as vulnerable this season, representing $1.3 trillion in potential reconstruction costs. (CoreLogic 2024 Wildfire Risk Report Finds More Than 2.6 Million ...) Median acreage burned nationwide has already breached ten-year averages. (How wildfires became a burning issue for insurance professionals)

Traditional MLS listings rarely highlight fire danger beyond a generic “Wildland-Urban Interface” note—leaving buyers to assume risk without context.

2. Smoke: The Silent Property Devaluer

Wildfire smoke isn’t a temporary nuisance; it’s an indoor air-quality hazard:

| Metric | Typical Spike During Nearby Fire | Source |

|---|---|---|

| PM₂.₅ concentration | 5–10× EPA 24-hr standard (35 µg/m³) | ([Why Wildfire Smoke is a Health Concern |

| HVAC filter lifespan | Cut in half | EPA IAQ studies |

| DIY mitigation cost | $200–$400 per room (HEPA units, MERV-13 filters) | CDC filtration review |

Fine particulate infiltration lingers—even after skies clear—leading to odor remediation bills and potential health-related disclosure issues at resale.

3. Insurance & Lending: The New Red Lines

- Carrier retreat. Major insurers have pulled out of parts of CA and OR; remaining policies carry deductibles up to 10 % of dwelling value. (How wildfires became a burning issue for insurance professionals)

- Mortgage overlays. Some lenders now require fire-hardening inspections (Class-A roofing, ember screens) before underwriting in Very-High zones.

- Premium inflation. A $500 k home in a high-risk ZIP can see annual premiums jump from $1,200 → $6,000 after a single local blaze.

4. Property Insights 101—How We Quantify Fire & Smoke Risk

| Data Feed | What We Analyze | Score Impact |

|---|---|---|

| CoreLogic burn probabilities | 30-yr fire frequency + fuel load | Base risk tier |

| NOAA smoke-plume satellite data | Historic PM drift paths | Smoke exposure modifier |

| Building permits | Roof/vent upgrades, defensible-space compliance | Mitigation credit |

| Local claims history | Prior wildfire payouts within 2 mi | Insurance-load factor |

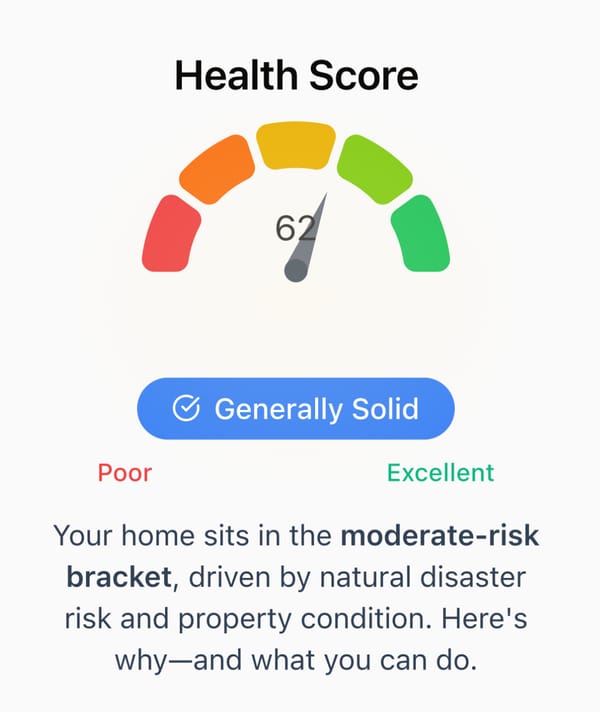

These features roll into our Wildfire Vulnerability Index (WVI)—a 0-100 scale surfaced on every Property Insights 101 report. A WVI > 70 triggers cost-to-mitigate estimates (Class-A roof, tempered-glass windows, exterior sprinklers) and a projected premium range based on current state filings.

5. Action Playbook

| Stakeholder | Immediate Move | Why |

|---|---|---|

| Homebuyer | Pull a WVI before waiving contingencies. | Premium shock can break DTI ratios post-close. |

| Inspector | Add rooftop & vent material checks to wildfire addendum. | Lenders are starting to demand it. |

| Realtor | Disclose smoke-day history + mitigation upgrades up front. | Transparency builds trust; avoids escrow delays. |

6. Takeaway

Wildfire risk is no longer confined to cabins in the hills; it’s creeping into suburban cul-de-sacs and urban fringes. Flames grab headlines, but smoke, insurance shifts, and financing friction erode property value quietly.

Property Insights 101 stitches together burn probability, smoke history, and mitigation data so you can price risk—before it prices you.

Next up: Flood-Zone Mirage—How “X-Zone” Properties Still Rack Up $20 k Losses.